Navigating the GS Pay Scale: A Comprehensive Guide to Locality Pay

Related Articles: Navigating the GS Pay Scale: A Comprehensive Guide to Locality Pay

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the GS Pay Scale: A Comprehensive Guide to Locality Pay. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the GS Pay Scale: A Comprehensive Guide to Locality Pay

The General Schedule (GS) pay scale, a standardized system for determining federal employee salaries, is intricately linked to the concept of "locality pay." This system, implemented by the United States Office of Personnel Management (OPM), adjusts base salaries based on the cost of living in different geographical areas across the country. Understanding the intricate workings of the GS pay scale and locality pay is crucial for both current and prospective federal employees, as it directly impacts their earning potential.

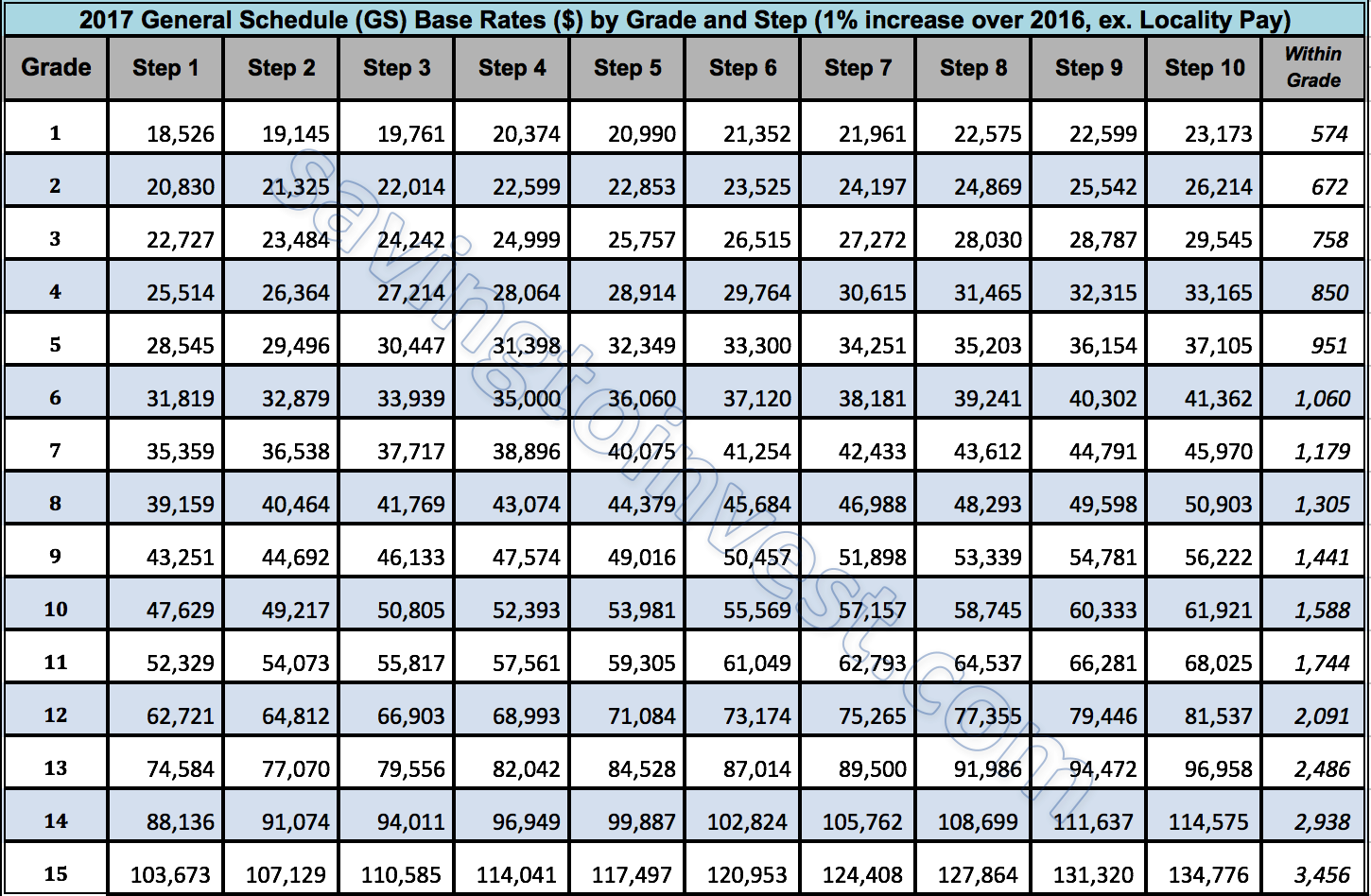

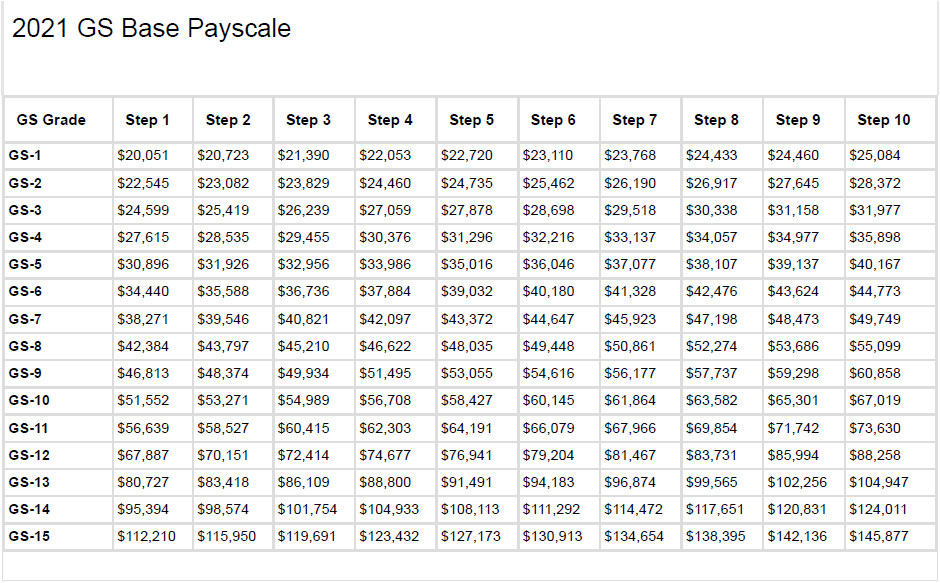

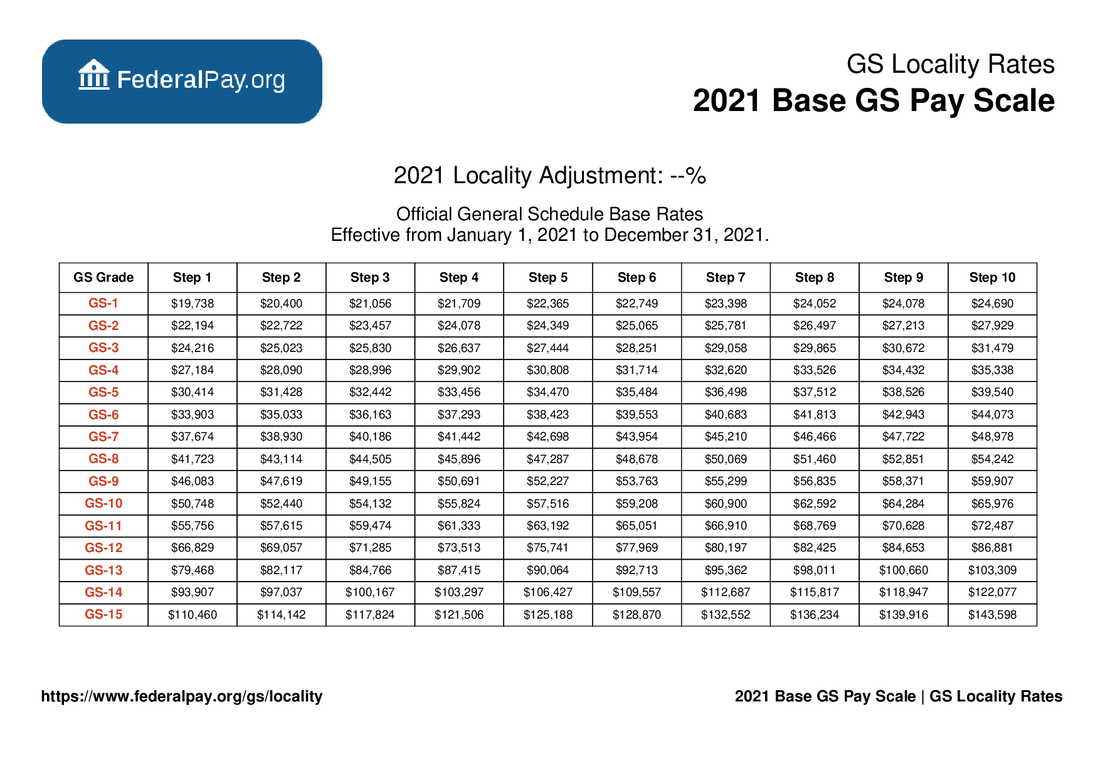

Understanding the GS Pay Scale

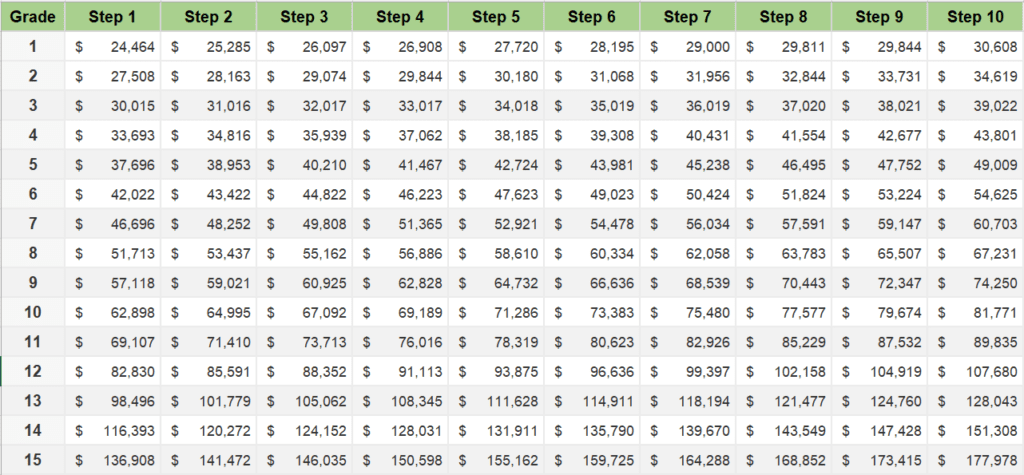

The GS pay scale is a hierarchical structure comprising 15 grades (GS-1 through GS-15), each further divided into 10 steps. Each grade represents a level of responsibility and expertise, with higher grades typically requiring greater experience, education, and skills. Within each grade, the steps denote incremental increases in salary, generally awarded annually based on performance and time in service.

The Significance of Locality Pay

The GS pay scale alone does not fully determine a federal employee’s salary. Locality pay, a crucial component of the system, adjusts base salaries based on the cost of living in specific geographical areas. This adjustment aims to ensure fair compensation for federal employees working in areas with higher costs of living, such as housing, transportation, and goods and services.

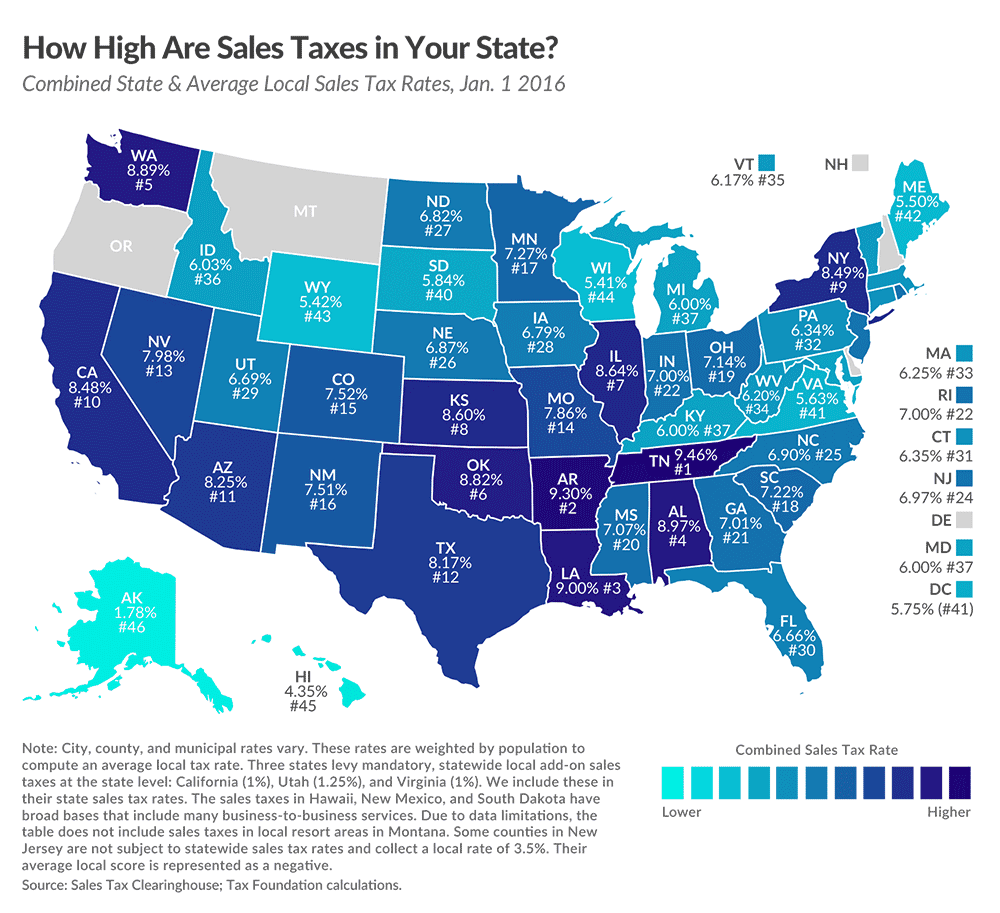

The Locality Pay Map

The OPM annually publishes a locality pay map, which visually represents the different locality pay areas across the United States. Each area is assigned a specific locality pay percentage, reflecting the cost of living in that region compared to a national average. This percentage is applied to the base salary determined by the GS grade and step, resulting in a higher adjusted salary for employees in areas with higher locality pay percentages.

How Locality Pay Affects Salaries

The impact of locality pay on salaries can be significant, particularly in areas with high costs of living. For example, a GS-11 employee in New York City may earn a substantially higher salary than a GS-11 employee in a rural area of the Midwest, due to the significantly higher locality pay percentage in New York City.

Example: GS-11, Step 5

-

Base Salary (GS-11, Step 5): $63,052

-

Locality Pay Area: New York City: 32.6%

-

Locality Pay Adjustment: $63,052 x 0.326 = $20,567

-

Adjusted Salary (New York City): $63,052 + $20,567 = $83,619

-

Locality Pay Area: Rural Midwest: 10.0%

-

Locality Pay Adjustment: $63,052 x 0.10 = $6,305

-

Adjusted Salary (Rural Midwest): $63,052 + $6,305 = $69,357

Navigating the Locality Pay Map

The OPM’s locality pay map is a valuable tool for both current and prospective federal employees. By understanding the map, employees can:

- Compare salaries across different locations: The map allows employees to compare salaries for the same GS grade and step in different areas, factoring in the impact of locality pay.

- Identify areas with higher earning potential: Employees seeking to maximize their earnings can identify areas with higher locality pay percentages.

- Negotiate salary during job applications: Knowing the locality pay for a specific area can be a valuable tool during salary negotiations for federal jobs.

Frequently Asked Questions (FAQs) about Locality Pay

1. How is locality pay determined?

Locality pay percentages are determined by the OPM based on a comprehensive analysis of cost-of-living data, including housing, transportation, food, and other expenses.

2. Does locality pay apply to all federal employees?

Locality pay applies to most federal employees covered by the GS pay scale. However, certain exceptions exist, such as employees in the Foreign Service or those with specific pay schedules.

3. Can locality pay change?

Yes, locality pay percentages can change annually based on fluctuations in the cost of living. The OPM updates the locality pay map and percentages each year.

4. How can I find my locality pay area?

The OPM website provides a searchable database and map to determine the locality pay area for any given location.

5. How does locality pay affect retirement benefits?

Locality pay is factored into the calculation of retirement benefits, as it is considered part of an employee’s base salary.

Tips for Understanding and Utilizing Locality Pay

- Stay informed about locality pay changes: Regularly check the OPM website for updates to the locality pay map and percentages.

- Consider the impact of locality pay during job searches: When considering job opportunities, factor in the locality pay percentage for the specific location.

- Utilize the OPM’s online tools: Take advantage of the OPM’s searchable database and map to research locality pay percentages for different areas.

- Negotiate salary based on locality pay: During salary negotiations, be aware of the locality pay percentage for the specific location and advocate for fair compensation.

Conclusion

The GS pay scale, in conjunction with locality pay, forms the cornerstone of federal employee compensation. Understanding the intricacies of this system is crucial for ensuring fair and competitive salaries. By utilizing the OPM’s resources and staying informed about locality pay adjustments, both current and prospective federal employees can navigate this complex system effectively and maximize their earning potential.

Closure

Thus, we hope this article has provided valuable insights into Navigating the GS Pay Scale: A Comprehensive Guide to Locality Pay. We appreciate your attention to our article. See you in our next article!